If you have been looking into home loans, you have probably come across the term Lenders Mortgage Insurance (LMI). It iss one of those costs that can take buyers by surprise, so let’s break it down simply.

What is LMI?

LMI is an insurance policy that protects the lender, not the borrower if you are unable repay your home loan. It kicks in when your deposit is less than 20% of the property’s value.

When do you pay it?

If you are borrowing more than 80% of a property’s purchase price (so your deposit is under 20%), most lenders will require you to add LMI. The premium is an one off cost that is calculated based on your loan size and deposit amount.

A quick example

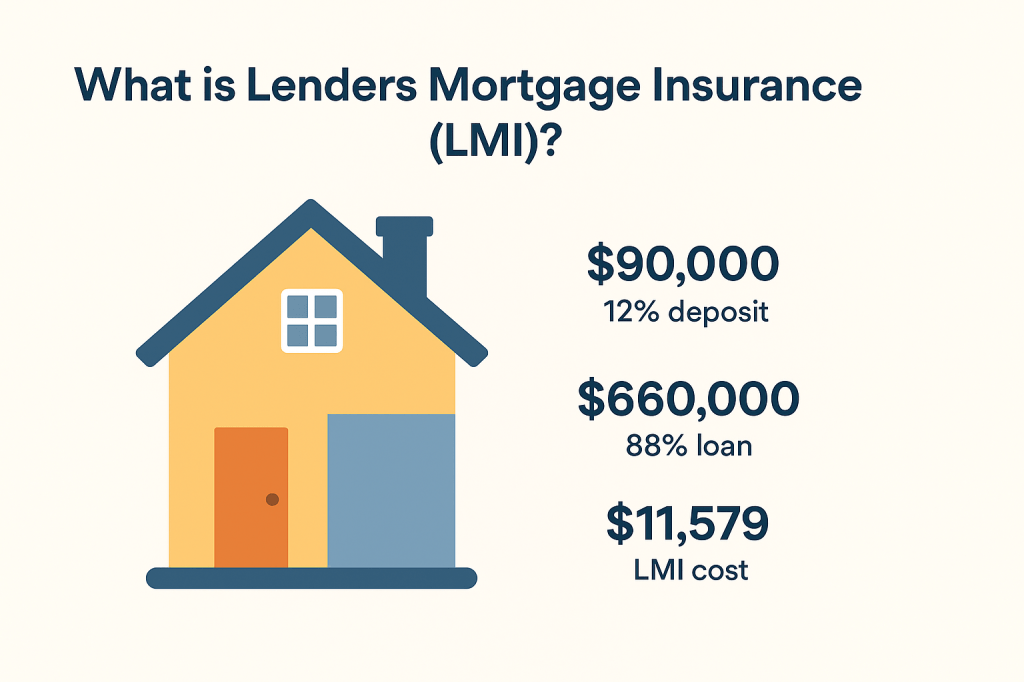

Let’s say you are buying a property for $750,000

- You have saved $90,000 (that’s a 12% deposit)

- Your loan amount would be $660,000 (88% of the purchase price)

- In this case, the LMI cost would be roughly $11,579

That is money that does not go towards your property, but it does allow you to buy with a smaller deposit and get into the market sooner. Generally LMI is added back into the loan amount, so in the above example the total lending would be $671579.

Why does it exist?

With a smaller deposit, the lender is taking on more risk. LMI reduces that risk, allowing the lender to approve your loan.

Can you avoid LMI?

Yes, in a few ways:

- Save at least a 20% deposit

- Use a government scheme like the Home Guarantee Scheme (lets you buy with 5% deposit and no LMI)

- In some cases, certain professions (like medical specialists) may be eligible for LMI waivers with certain lenders

The takeaway

LMI protects only the lender, but it can help you buy a home sooner if you do not have a 20% deposit saved. The key is knowing when it makes sense to pay it, and when you might have other options.

At Sure Path Finance, we can run the numbers and show you the best path forward, whether that is paying LMI, using a government scheme, or avoiding it altogether.

Leave a comment